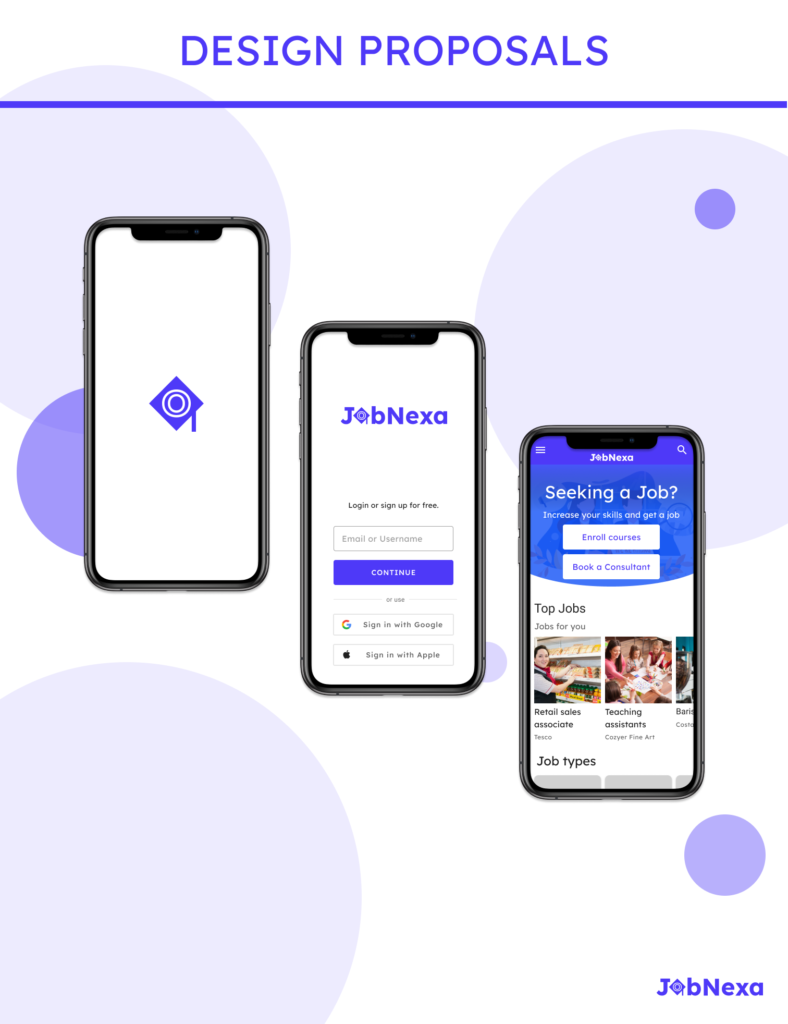

JobNexa

Best job market for the students in UK

The 559,825 international students have started their studies since September 2023,

which is a 23.7% increase from the previous year’s statistics 50% of the international students are seeking jobs without having previous job experience. This problem affects the work environment and the ability to maintain consistent work. As a result, a lot of recruiters are suffering to short out the perfect team member from the crowd, and on the other hand, students are losing their opportunity to get a job or retain the job due to a lack of experience. In the following January session, numerous students will join in. It is high time to mitigate this problem from both sides by providing soft skills and career training for the perfect job match. This app will increase student’s confidence and competency to get a part-time job and pursue their studies. On the other hand, the recruiter will easily find the perfect team members.

MindMate

Ai Chatbot MindMate to dealing anxiety

There has been an “explosion” in anxiety across Britain over the last decade, according to research by Cambridge. Over 8 million people are experiencing an anxiety disorder at any one time according to Mental Health UK and a research of Mental Health Foundation revealed that Less than 50% of people with generalised anxiety disorder access treatment in the uk. One adult in eight (12.1%) receives mental health treatment, with 10.4% receiving medication and 3% receiving psychological therapy. The overlap within the statistics is due to 1.3% of those receiving treatment reporting receiving both medication and psychological therapy. So we picked this topic to make a chatbot “MindMate” to empower users to navigate their anxiety with confidence.

This app will help people to mitigate their anxiety.

Lloyds Bank

A complete solution for smart banking

The primary goal of the Lloyds Bank Mobile App Rebranding Project is to improve the app’s usability for young adults. We’re updating it to reflect the needs and preferences of millennials regarding their bank app. Our objectives are to maintain the Lloyds Bank brand while making it easier to use, helping users understand their financial saving goals, health insurance and keeping them engaged in their retirement plan. Our primary goal for the app is to give millennials a useful tool for budgeting and future planning.Due to low-interest savings rates, a lot of young adults have recently expressed dissatisfaction with traditional banking options. Many millennials or young adults struggle to use banking apps and manage their finances. They frequently have trouble setting goals, figuring out financial terminologies, and getting the help they need.